What is e-invoicing under GST?

E-invoicing under the Goods and Services Tax (GST) is a system of generating and validating invoices electronically. It simplifies the invoicing process and ensures the authenticity and integrity of the invoices. Under e-invoicing, businesses have to generate invoices in a prescribed format digitally and submit them to the government’s designated Invoice Registration Portal (IRP).

The IRP validates the invoice and generates a unique Invoice Reference Number (IRN) and a QR code. These details are then embedded on the invoice, making it a valid electronic invoice. E-invoicing helps in reducing errors, improving efficiency, and eliminating the need for manual data entry during compliance processes.

To whom will e-invoicing apply?

E-invoicing can apply to businesses and organizations of all sizes, including small businesses, medium-sized enterprises, large corporations, and government entities. It is applicable to organizations involved in various industries such as retail, manufacturing, services, healthcare, finance, and more.

Process of getting an e-invoice

The process of getting an e-invoice typically involves the following steps-

1. Determine Eligibility: First, you need to check if you are eligible for e-invoicing. This depends on various factors like your country’s regulations, the industry you operate in, and your turnover.

2. Choose an E-Invoicing Solution: Once you determine your eligibility, you need to choose an e-invoicing solution that meets your requirements. There are various software providers and service providers that offer e-invoicing solutions. Consider factors like cost, features, and compatibility with your existing systems before making a selection.

3. Register with E-Invoicing Platform: Register with the chosen e-invoicing platform and complete any necessary paperwork or documentation required for account setup.

4. Integration with Accounting Software: Integrate the e-invoicing platform with your existing accounting software to ensure seamless data flow and automation of the invoicing process.

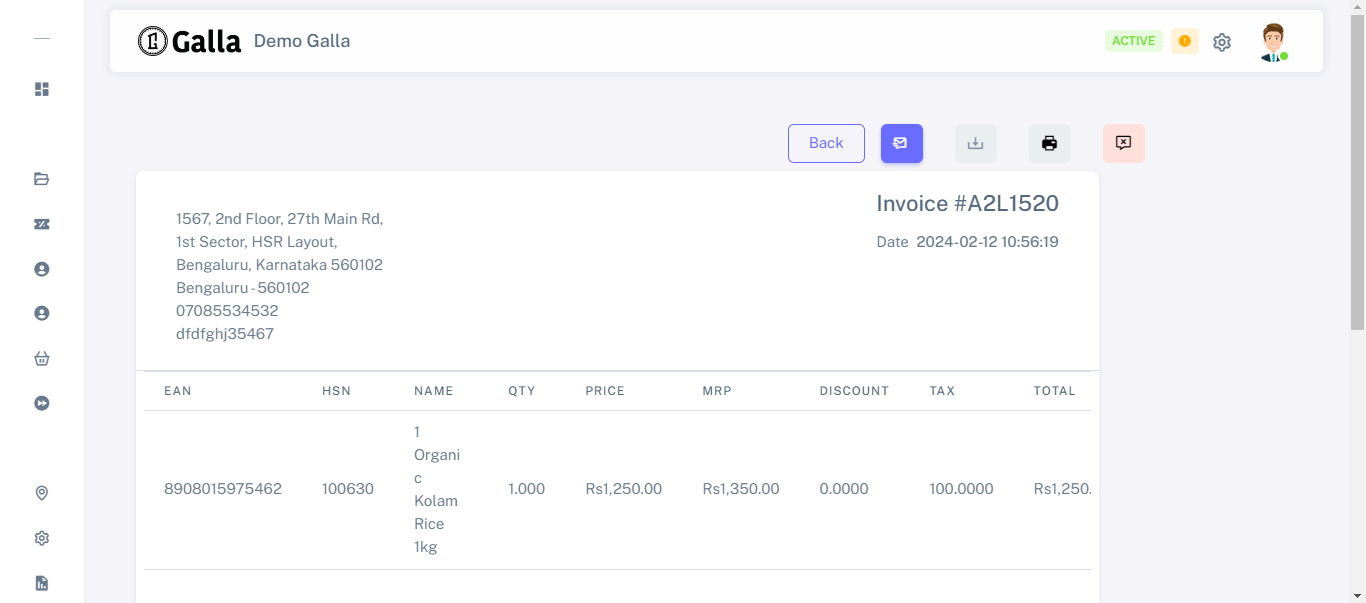

5. Generate E-Invoices: Create and generate e-invoices using the e-invoicing platform. These invoices may have a specific format or structure as mandated by the regulatory authorities.

6. Validate & Sign Invoices: Validate the e-invoices for accuracy and compliance with relevant regulations. Some e-invoicing platforms provide features for digital signatures or electronic seals on the invoices to ensure their authenticity.

7. Transmit & Receive Invoices: Send the e-invoices to your customers electronically through the e-invoicing platform. Similarly, receive e-invoices from your suppliers or vendors through the platform.

8. Storage Archiving: Store the e-invoices securely as per legal requirements. E-invoices typically need to be stored for a certain period to comply with regulations and facilitate audits.

9. Reporting & Analytics: Utilize the reporting and analytical features offered by the e-invoicing platform to gain insights into your invoicing process, track payments, and manage cash flow effectively.

10. Compliance with Legal Requirements: Ensure that you comply with all legal and regulatory requirements related to e-invoicing, such as maintaining records, adhering to tax regulations, and following any specific guidelines applicable in your jurisdiction.

It is important to consult with professionals or seek guidance from relevant authorities to ensure compliance and a smooth transition to e-invoicing.

Benefits of e-Invoicing to Businesses

There are several benefits of e-invoicing to businesses, including:

1. Cost Savings: E-invoicing reduces the cost of invoice processing by eliminating manual tasks such as printing, mailing, and data entry. This can result in significant cost savings for businesses.

2. Time Savings: E-invoicing reduces the time required for invoice processing, as electronic invoices can be quickly created, sent, received, and processed. This gives firms more time to concentrate on other crucial responsibilities.

3. Improved Accuracy: E-invoicing reduces the risk of human errors that can occur during manual data entry. Electronic invoices can be automatically generated and processed, minimizing the chances of mistakes.

4. Faster Payment Processing: E-invoicing can accelerate the payment process by eliminating delays caused by postal services or manual invoice handling. Businesses can receive payments faster, improving cash flow.

5. Increased Efficiency: E-invoicing streamlines the entire invoicing process, reducing the need for paper-based transactions and manual handling. This improves efficiency and productivity within the business.

6. Enhanced Visibility & Reporting: E-invoicing provides businesses with real-time visibility into their invoicing process. They can track invoice status, monitor payment trends, and generate reports to analyze and optimize their financial operations.

7. Improved Supplier Relationships: E-invoicing improves communication and collaboration between businesses and their suppliers. It allows for quick and efficient exchange of invoices, reducing disputes and improving relationships.

8. Environmental Benefits: E-invoicing reduces the use of paper, ink, and other resources used in traditional invoicing processes. This helps businesses reduce their carbon footprint and contribute to environmental sustainability.

9. Simplified Compliance: E-invoicing can help businesses comply with tax regulations and other financial requirements more easily. Electronic invoices can be standardized and easily integrated into accounting systems, simplifying compliance procedures.

Overall, e-invoicing offers numerous benefits to businesses, from cost and time savings to improved efficiency and accuracy. It is a valuable tool for streamlining invoicing processes and enhancing the overall financial operations of a business.

How can e-invoicing curb tax evasion?

E-invoicing can curb tax evasion in several ways-

1. Increased Transparency: E-invoicing provides a digital trail that tracks the flow of invoices, making it harder for businesses to manipulate or hide their transactions. Tax authorities can access this data easily, enabling them to better identify discrepancies and detect potential tax evasion.

2. Real-Time Reporting: E-invoicing allows for real-time reporting of sales and purchases, helping tax authorities monitor transactions more effectively. This helps prevent businesses from underreporting or omitting transactions, reducing the opportunities for tax evasion.

3. Improved Accuracy: E-invoicing systems automate data entry and reduce manual errors, which can be used to manipulate financial records and evade taxes. By minimizing errors, e-invoicing ensures accurate reporting, making it difficult for businesses to misrepresent their financial activities.

4. Enhanced Audit Capabilities: E-invoicing systems facilitate seamless data exchange between businesses and tax authorities, enabling easy auditing of transactions. Tax authorities can cross-check the information provided by businesses in real-time, enabling them to detect any discrepancies or suspicious activities promptly.

5. Reduced Cash Transactions: E-invoicing encourages electronic payments and discourages cash transactions, which are often associated with tax evasion. By promoting digital payments, governments can monitor financial transactions more effectively, reducing opportunities for businesses to evade taxes.

Overall, e-invoicing streamlines the invoicing and payment process, enhances transparency, and provides better tools for tax authorities to monitor and verify transactions. This, in turn, helps combat tax evasion and promotes a fair and efficient tax system.

SUMMING UP

E-invoicing, or electronic invoicing, is the process of generating and exchanging invoices digitally instead of using traditional paper-based methods. In India, the government has implemented a system for e-invoicing to streamline and digitize the invoicing process.

Businesses implementing e-invoicing in India benefit from reduced paperwork, faster payment cycles, and improved accuracy in invoicing. It also facilitates seamless data integration with other systems, such as accounting and enterprise resource planning (ERP) software.

Overall, e-invoicing in India is a significant step towards digitizing and modernizing the invoicing process. It is expected to bring about several benefits for businesses, the government, and the overall economy.